Financing

AguaZen Pools

Pool Financing Options

Pool financing is not one-size-fits-all, which is why it is important to carefully consider the pros and cons of each to ultimately decide which type of financing best fits your needs.

In-House Pool Loans

PROS: Convenient and streamlined process

CONS: You should still shop around for the best rate

One of the easiest ways to pay for a new pool is by getting a pool loan. Many people do this by working with their pool company, which can help them get a loan from a trusted lender. This makes the process simple because the pool company knows what information is needed, can help with paperwork, and answer any questions. It also helps speed things up and makes it easier to get approved for the loan—a win for everyone!

Even though getting a loan through your pool company is easy, it might not always have the best rates or terms. It’s a good idea to check different lenders to find the best deal for you.

At Aguazen Pools, we work with Latham who has two trusted lenders, Lyon Financial and LightStream, to help homeowners find the right pool loan.

Latham’s Preferred Financing Partners

Latham Pools has partnered with Lyon Financial and LightStream as preferred lenders.

Learn more about these options and apply today:

Lyon Financial Pool Loans

Lyon Financial is different from other financial organizations in that they have specialized in pool loans since 1979. As a result, they have a knowledgeable team that can help guide you through the pool loan process and offer personalized service. As an additional value add, Lyon Financial will partner with the homeowner and pool professional until the project is complete.

With pool loans from Lyon Financial, you can get loans of up to $200,000* for terms of up to 30 years*. They also offer low, fixed rates, with no consulting fees or prepayment penalties.

Learn more about Lyon Financial and get in touch with one of their knowledgeable representatives today.

LightStream Pool Loans

For homeowners looking for a more-self serve lender, Latham Pools has partnered with LightStream. A premier online lender, LightStream offers fast, easy pool loans of up to $100,000 at low, fixed rates without

any fees or prepayment penalties for customers with good to excellent credit.

This is a good option for customers who are more financially savvy or already know what they’re looking for from a loan and don’t need as much support from their lender.

Learn more about LightStream and apply today.

Swimming Pool Financing 101

How Does A Pool Loan Work?

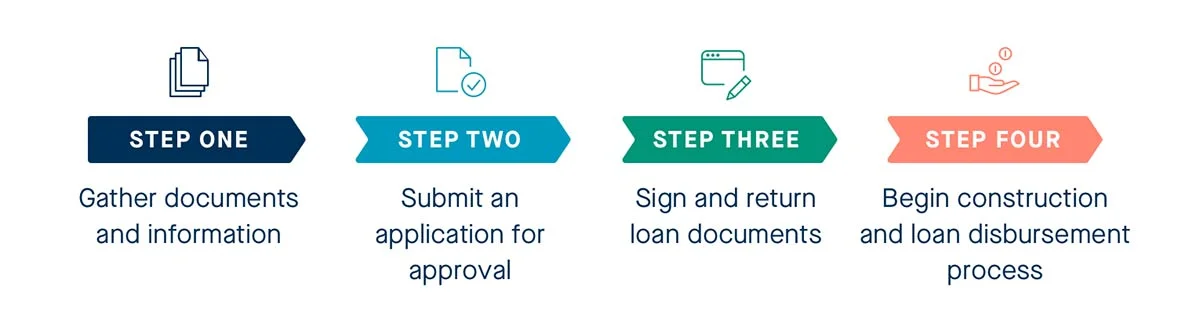

While the process for obtaining a pool loan will likely look fairly similar to most other types of loan applications, there are some parts that are specific to swimming pool loans.

First, before you begin the loan application process, you should have the following documents and information ready to share with the financial institution:

- Social security number (SSN)

- Driver’s license number

- Proof of employment

- Proof of income

- List of assets

- List of liabilities

The process begins when you submit a loan application. From there, your application will be reviewed and a credit check will be run. At this point, the loan will either be denied or conditionally approved. If you are conditionally approved, the lender will typically request documentation to verify your income (such as tax returns, W-2 or a recent paystub).

Once this is completed and a copy of the signed contract between you and your pool dealer is in hand, loan documents are ordered and sent electronically. After the documents are signed and returned, your builder is given a green light to begin construction.

If you’re getting a pool loan through a lender that specializes in pool loans, like Lyon Financial, they’ll be able to guide you through the process and answer any questions that you might have. They will also help facilitate loan disbursement, which for pools is usually done in stages as the project progresses.

Financing a Pool Into a Mortgage

Homeowners often wonder if they can finance a pool into a new mortgage. The short answer is yes, but it will likely depend on your mortgage lender and specific financing terms.

There are a couple of ways to go about combining your pool loan into a mortgage:

- Factor it into a new mortgage: If you decide early on in the home buying process that you want to add a pool to your new home, you might be able to consolidate the cost of your new pool directly into your new mortgage. However, not all lenders will allow this, so you will need to ask to see if this is possible.

- Refinance and cash out: Alternatively, if you already own a home and have a mortgage, you can potentially refinance your existing mortgage and cash out some of the equity in your home to pay for your new pool.

- Take out a second mortgage: Another popular option is to take out a “second mortgage” in the form of a home equity loan.

Financing your pool in this way can help you get a better interest rate and streamline both the application and payment process.

Typical Pool Loan Terms

When determining if a pool loan is right for you, it is important to understand what to expect with a typical loan. While specific loan terms may differ depending on your needs and circumstances, generally speaking, most pool loans have a term length of 1–30 years, with typical interest rates anywhere from 7.5% to 11%.

Read on to learn more about typical pool loan terms. To get more information about specific loan terms, visit our partners, Lyon Financial and LightStream.

*Interest rates and terms sourced from Investopedia and Nerdwallet and are subject to change without notice.

What is the Average Interest Rate on a Pool Loan?

Interest rates for pool loans depend on a number of factors, including credit profile, loan amount and income.

Generally speaking, average pool loan interest rates fall in the 7.5–11% range on average. The interest rate you qualify for will largely depend on your creditworthiness.

Your lender can help you shop around for the best interest rate or you can use an online lender to shop around for rates yourself.

*Interest rates and terms sourced from Investopedia and Nerdwallet and are subject to change without notice.

What is the Average Monthly Payment on a Pool Loan?

Monthly payments on your pool loan will vary based on a number of factors, including the loan term, interest rate and amount financed.

To put this in perspective, a $30,000 loan over 84 months could cost anywhere between $400-$500 per month. A $40,000 loan over the same term would result in a monthly payment of $630 to $675, while a $50,000 loan would cost about $750–$850 per month.

However, if you extend your loan term beyond the standard 84 months, you can lower your monthly payments considerably, making a pool more attainable for many. The trade-off is that you will likely pay more interest on the loan over time.

For example, if you choose a 180-month loan term, your average monthly payment could be approximately $200-$300 less. If you finance $50,000, your payments might be around $515 per month. A $30,000 pool would cost roughly $310 per month.

You can also lower your monthly payment by putting a down payment to reduce the amount of money you’re ultimately financing.

Using a swimming pool loan calculator like the one Lyon Financial provides can help you get a feel for how these factors impact your monthly payment.

*Interest rates and terms sourced from Investopedia and Nerdwallet

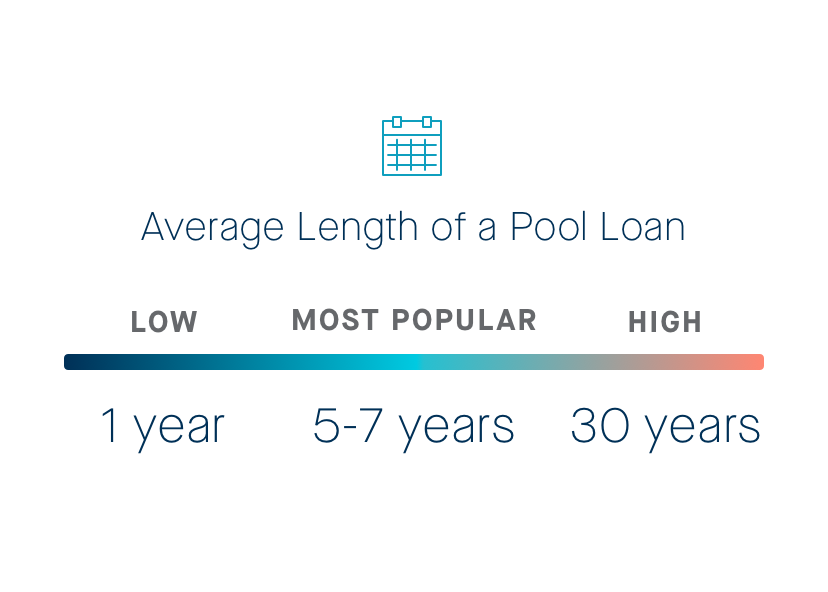

How Long Can You Finance a Pool?

The average length of a pool loan can range anywhere from 1-30 years, depending on your needs and how much you need to finance.

As mentioned, the length of time you finance your pool for can have a significant impact on your monthly payments. If you choose a shorter loan term, your monthly payments will be higher, but you will ultimately pay less in interest. If you go with a longer term, your monthly payments will be lower, but you’ll pay more in interest.

Five- to seven-year loans tend to be a popular choice, because they help spread the cost of the pool over enough time that your monthly payments are relatively low, but you don’t rack up decades of interest.

Ultimately, the length of your pool loan that you choose is up to you and what best fits your needs — and your budget!

*Interest rates and terms sourced from Investopedia and Nerdwallet

What Credit Score is Needed for a Pool Loan?

If you’ve decided that a pool loan is right for you, the next logical question is what credit score is needed and if you qualify.

When evaluating a loan application, lenders ideally want at least five years of credit history consisting of a variety of account types (such as mortgages, vehicle loans and major credit cards) with a record of consistent on-time payments. Additionally, lenders will also consider your income and debt-to-income ratio to help determine your ability to repay the loan.

Typically, lenders are looking for a credit score of at least 660. As with any loan, those with good-to-excellent credit (740+) will get the better interest rates and lower monthly payments.

However, even if you have “bad” credit, it may still be possible to get a pool loan. But, beware, as this will likely come at the cost of a significantly higher interest rate, adding to the overall cost of the pool.